Insurance plays a crucial role in the global economy, offering financial protection to individuals, businesses, and governments. Some countries have excelled in building robust insurance sectors, providing comprehensive coverage and fostering trust among policyholders. Whether you’re an expat, an investor, or simply curious, understanding which countries lead the insurance industry can be incredibly beneficial.

This comprehensive guide explores the best insurance countries, delving into what makes their insurance markets thrive, their strengths, and why they’re worth considering.

Factors Defining the Best Insurance Countries

A strong insurance market is shaped by several critical factors, including:

- Market Size: The total premiums written and the size of the insured population.

- Regulatory Environment: Transparent, consumer-focused laws that ensure fair practices.

- Insurance Penetration: The percentage of GDP spent on insurance, reflecting its role in the economy.

- Innovation: Use of technology to streamline processes and offer modern solutions.

- Economic Stability: A stable economy supports both insurers and policyholders.

- Accessibility: The ease with which individuals and businesses can obtain adequate coverage.

Top Insurance Countries and What Sets Them Apart

1. United States

- Why It Stands Out: Largest insurance market globally.

- Key Statistics:

- Accounts for approximately 40% of global insurance premiums.

- High insurance penetration, especially in health and life insurance.

Strengths:

- A diverse and competitive market offering extensive options for consumers.

- Cutting-edge technology in insurance (InsurTech).

- Well-established regulations through organizations like the National Association of Insurance Commissioners (NAIC).

Challenges:

- High costs in health insurance.

- Complex policies that may confuse consumers.

2. United Kingdom

- Why It Stands Out: A hub for global insurance and reinsurance markets.

- Key Statistics:

- London is a leading center for reinsurance and specialty insurance.

- Significant contributions to the global insurance landscape.

Strengths:

- Home to Lloyd’s of London, a global leader in specialty insurance.

- Strong regulatory framework through the Financial Conduct Authority (FCA).

- Focus on innovative products like cyber insurance.

Challenges:

- Brexit has caused uncertainties in cross-border policies.

3. Germany

- Why It Stands Out: Europe’s largest economy with a robust insurance market.

- Key Statistics:

- Insurance penetration of 6% of GDP.

- A large domestic market complemented by global reinsurance leaders like Munich Re and Allianz.

Strengths:

- Stability and trust in insurers.

- Wide adoption of life and health insurance.

- Globally recognized reinsurers.

Challenges:

- Aging population leading to higher claims in health insurance.

4. Japan

- Why It Stands Out: High insurance penetration and consumer trust.

- Key Statistics:

- Life insurance is particularly significant, with Japan ranking among the top globally.

- Insurance penetration at 8.4% of GDP.

Strengths:

- Strong focus on life and long-term care insurance.

- Innovative use of technology in customer service.

Challenges:

- Low-interest rates affect profitability for insurers.

5. Switzerland

- Why It Stands Out: Known for financial services and strong insurance governance.

- Key Statistics:

- One of the highest per capita insurance expenditures globally.

- Leading in reinsurance with Swiss Re.

Strengths:

- High consumer trust due to financial stability.

- Comprehensive health and life insurance markets.

Challenges:

- Premiums can be higher compared to other countries.

6. Singapore

- Why It Stands Out: A key financial and insurance hub in Asia.

- Key Statistics:

- Insurance penetration at 6% of GDP.

- Rapid growth in digital insurance platforms.

Strengths:

- Favorable regulatory environment fostering growth and innovation.

- Strong position in reinsurance and marine insurance.

Challenges:

- Limited domestic market size.

7. Canada

- Why It Stands Out: Offers comprehensive coverage for health, auto, and property insurance.

- Key Statistics:

- Highly regulated market ensuring consumer protection.

- Insurance penetration of 6.3% of GDP.

Strengths:

- Government-supported health insurance.

- A stable market with competitive options.

Challenges:

- Climate-related risks driving up property insurance premiums.

8. Australia

- Why It Stands Out: A leader in personal and property insurance.

- Key Statistics:

- Insurance penetration at 5.3% of GDP.

- High adoption of flood and wildfire coverage.

Strengths:

- Proactive in managing climate risks.

- Strong consumer protection laws.

Challenges:

- Rising premiums due to frequent natural disasters.

9. France

- Why It Stands Out: One of Europe’s most comprehensive insurance markets.

- Key Statistics:

- Insurance penetration at 9% of GDP.

- A leader in life and property insurance.

Strengths:

- Government support in health and social insurance.

- Large insurers like AXA operate globally.

Challenges:

- Complex tax structures for policyholders.

10. China

- Why It Stands Out: Rapidly growing insurance market.

- Key Statistics:

- Second-largest insurance market globally.

- Insurance penetration rising annually, currently at 4.5% of GDP.

Strengths:

- Massive population base driving growth.

- Focus on technology-driven solutions.

Challenges:

- Regulatory challenges and regional disparities.

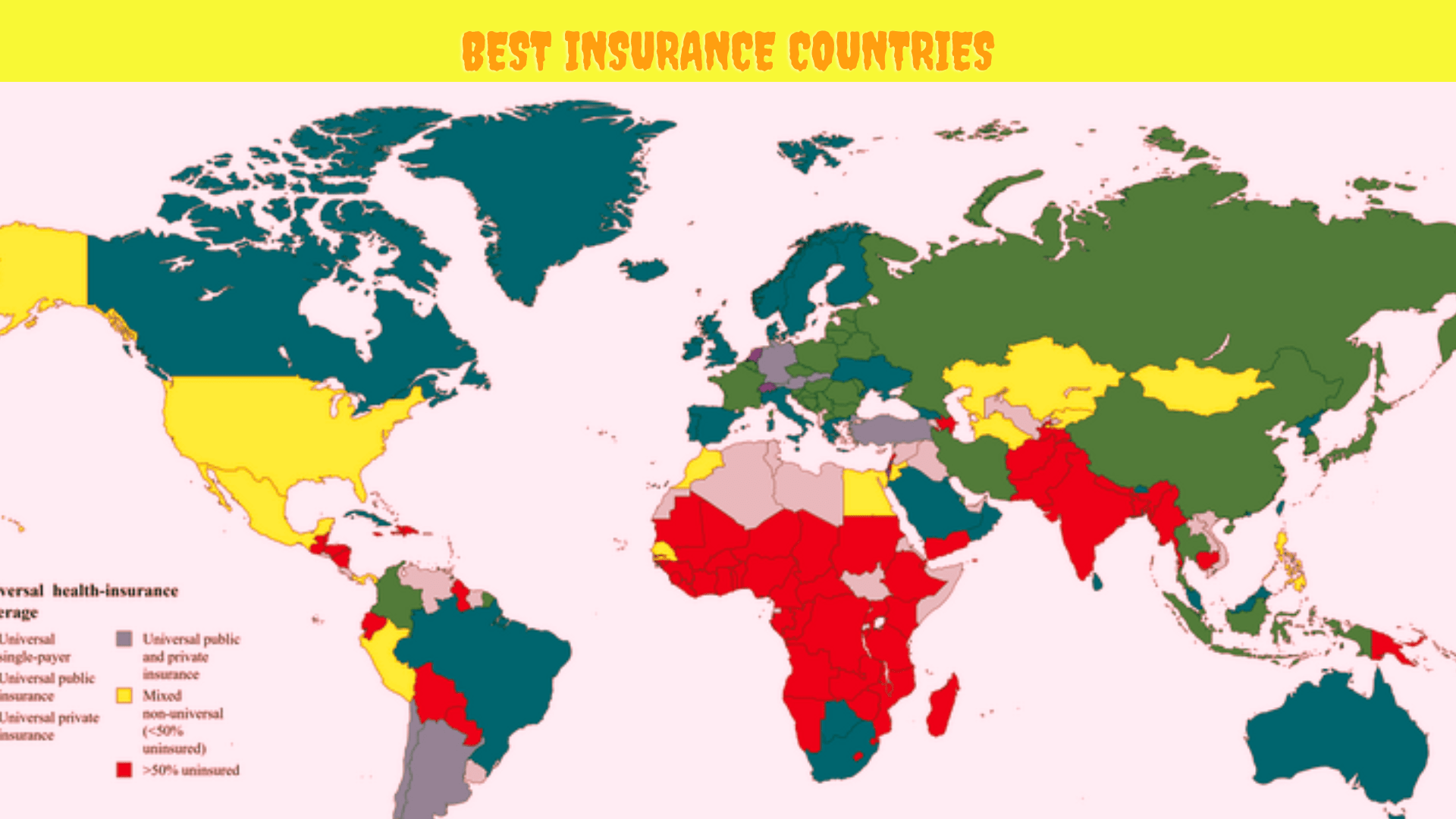

Emerging Insurance Markets

While developed nations dominate the insurance landscape, several emerging markets are making significant strides:

- India: Rapid growth in life and health insurance due to increasing awareness and digital platforms.

- Brazil: Latin America’s largest insurance market, driven by rising middle-class incomes.

- South Africa: A leader in Africa’s insurance sector, with advanced health and life insurance markets.

Why Insurance in These Countries Thrives

Economic Stability

Stable economies foster trust in insurers, ensuring timely payouts and market growth.

Strong Regulatory Frameworks

Countries like the UK, Germany, and Singapore enforce strict regulations that protect policyholders and ensure ethical practices.

Innovation and Technology

InsurTech, telematics, and AI are transforming how policies are sold, managed, and claimed, with leaders like the US and China at the forefront.

Cultural and Consumer Awareness

Countries with high insurance penetration often have a culture that values risk mitigation, like Japan and Switzerland.

Conclusion

The best insurance countries offer a combination of economic stability, regulatory excellence, and innovative approaches to meet diverse consumer needs. Whether you’re looking to relocate, invest, or simply find inspiration for improving your insurance choices, countries like the US, UK, Germany, and Singapore provide excellent examples of thriving insurance markets.

Understanding global trends and best practices can help you make informed decisions, ensuring financial security and peace of mind, no matter where you are.